On February 15, 2022, Iraq’s Federal Supreme Court (IFSC) ruled that the Kurdistan Regional Government’s (KRG) Oil and Gas Law No. 22 of 2007 violated the Iraqi Constitution and annulled it. The KRG had long argued that this law granted them energy independence. With the annulment, the court ordered the KRG to hand over all oil and gas revenues to the central government in Baghdad.

Table Of Content

It has been 28 months since Baghdad shut down the Kirkuk-Ceyhan oil pipeline, claiming that the KRG was exporting oil through Türkiye without federal approval.

During this time, Baghdad filed a complaint with the International Chamber of Commerce (ICC) Arbitration Court, asserting that Türkiye violated the 1973 Pipeline Transit Agreement. The ICC ruled in favor of Iraq, ordering Türkiye to pay $1.5 billion in damages for allowing unauthorized exports of KRG oil. Iraq was also fined $500 million for neglecting pipeline maintenance.

Efforts to establish a new agreement between Baghdad and Erbil have faced repeated obstacles. However, several dynamics have pushed both parties toward compromise: the U.S.’s strong support for the KRG’s energy independence efforts, Türkiye’s desire for a greater role in regional energy corridors, OPEC+ quota tensions, and oil price volatility. With the Kirkuk-Ceyhan pipeline offline for over two years, Iraq’s oil-dependent economy and the KRG’s export losses have made a new deal increasingly urgent.

OPEC+ Quota

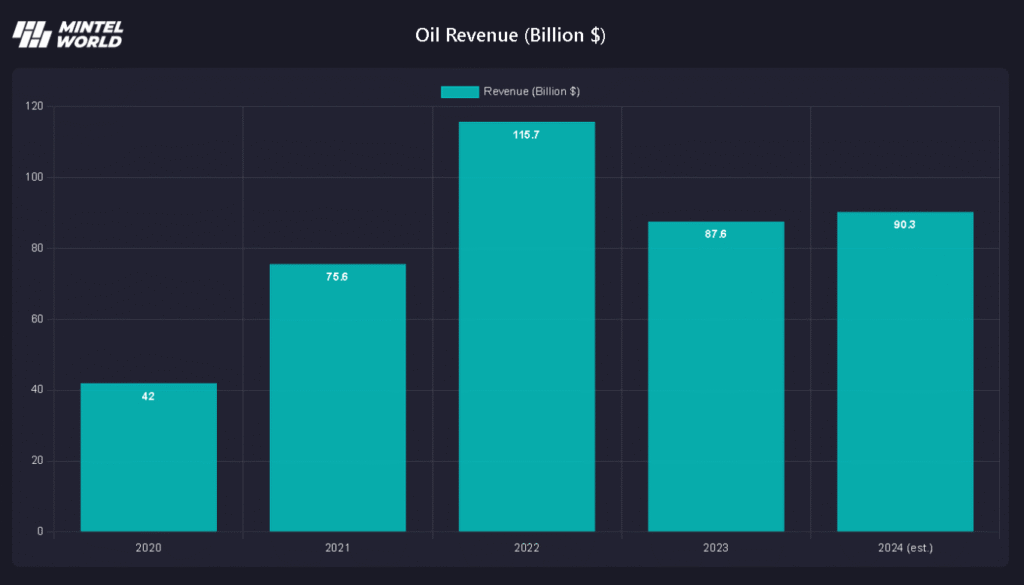

In recent months, Brent crude fell to $60 per barrel, creating severe financial stress for Iraq.

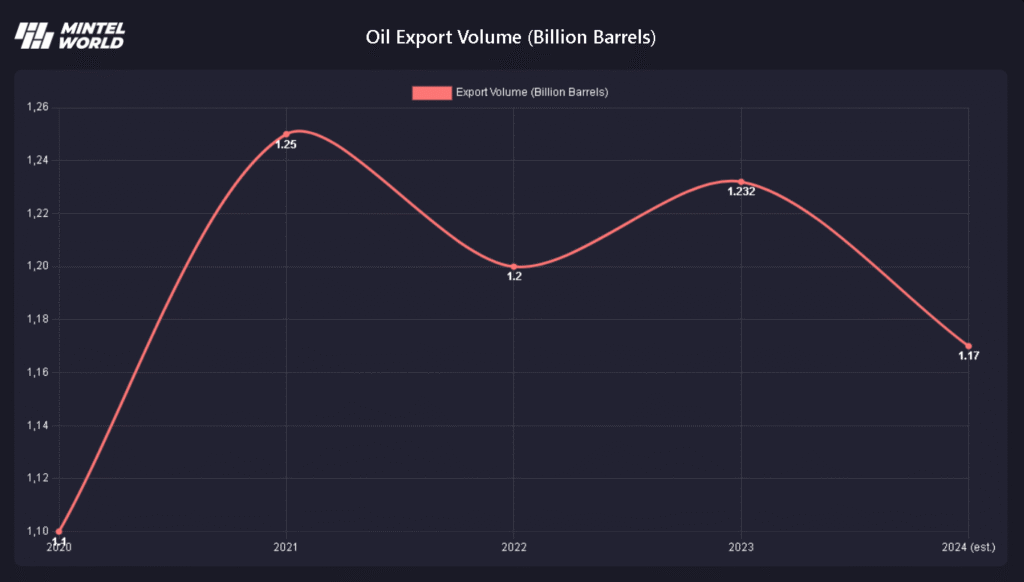

Iraq exports an average of 1.1 billion barrels of oil each year.

These exports generate nearly $100 billion in annual revenue.

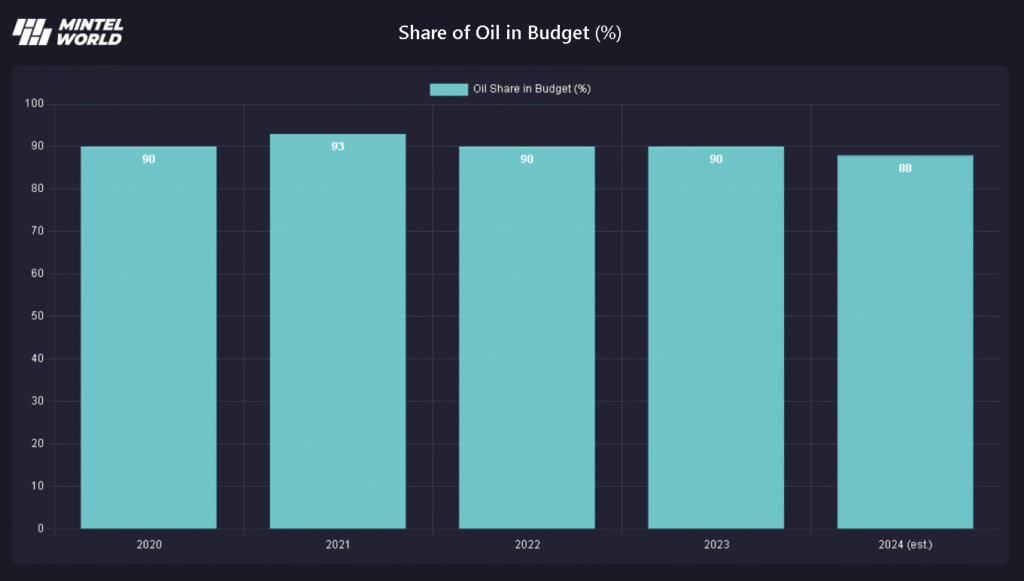

This income accounts for more than 90% of the country’s national budget. When oil prices dropped, Iraq sought to increase production to cover the growing budget deficit.

However, Saudi Arabia, eager to reassert itself as a dominant force within OPEC+, did not welcome Iraq’s production increases. Riyadh warned member states by threatening to lower prices further and responded by raising its own output to penalize Iraq and Kazakhstan for breaching quotas. Iraq later attempted to comply by cutting production, but this led to shortfalls in oil output from the KRG.

State Organization for Marketing of Oil (SOMO), Iraq’s sole authorized oil marketing body, stated that it could not control oil exports from the KRG. It cited this as a key reason Iraq failed to fully adhere to OPEC+ quotas. SOMO stressed that full compliance would be impossible without oversight of KRG production and exports.

Electricity Crisis in Iraq

In March 2025, the U.S. revoked Iraq’s waiver to import electricity from Iran and demanded that Iraq cease Iranian gas imports as soon as possible. Iran had been supplying Iraq with 40–50 million cubic meters of gas daily, covering roughly 43% of the country’s electricity needs.

By 2025, Iraq’s estimated electricity demand stood at about 54 GW, while its existing base capacity hovered around 15 GW. Even with imported Iranian gas and electricity, Iraq could only generate a maximum of 27 GW before supply cuts. In July 2025, Iran halved its gas deliveries, reducing Iraq’s production to 17 GW and causing power outages of up to 20–22 hours per day in some regions.

Prime Minister Mohammed Shia’ al-Sudani confirmed a shortfall of 4,000 MW due to insufficient gas supply from Iran. To address this gap, Iraq signed several new energy agreements:

Alifrin Electricity Link (Türkiye)

- Sector: Electricity import

- Partner: Alifrin (Türkiye)

- Capacity/Impact: 300 → 600 MW

- Details: The capacity of the 400 kV transmission line between Iraq and Türkiye was doubled. Due to Iraq’s previous payment delays, a “Take & Pay” model was introduced, meaning payments are made based on actual electricity consumption.

Turkmenistan Gas Import

- Sector: Natural gas import

- Partner: Türkmenistan

- Capacity/Impact: ~10 million m³/day

- Details: Aims to reduce dependence on Iranian gas. Expected to contribute approximately 3–4 GW to electricity production in the medium term.

Khor al-Zubair LNG Terminal

- Sector: LNG import

- Partner: Iraq Ministry of Oil

- Capacity/Impact: ~5–6 million m³/day

- Details: A floating terminal will be established for LNG imports from Katar and Umman.

Saudi Arabia Electricity Import

- Sector: Electricity import

- Partner: Suudi Arabistan, Gulf Cooperation Council (GCC)

- Capacity/Impact: ~1.5–2 GW

- Details: Provides alternative electricity capacity through connection to the Gulf grid, reducing dependence on Iranian electricity.

Karpowership Powership (Türkiye)

- Sector: Power generation

- Partner: Karpowership (Karadeniz Holding – Türkiye)

- Capacity/Impact: ~400–500 MW

- Details: The Orka Sultan ship will provide emergency electricity supply from the port of Basra.

ACWA Power Solar Project

- Sector: Solar energy

- Partner: ACWA Power (Saudi Arabia)

- Capacity/Impact: >1 GW

- Details: Aims to reduce reliance on gas-based electricity production, especially from Iran.

Masdar Solar Project

- Sector: Solar energy

- Partner: Masdar (UAE)

- Capacity/Impact: >1 GW

- Details: Supports Iraq’s renewable energy goals and helps lower energy import dependency.

To address its energy shortfall, Iraq has implemented fast-track solutions like the 600 MW Alifrin link and the 400–500 MW Karpowership plant. In the medium-to-long term, Iraq aims to reduce external reliance through projects involving Turkmen gas, LNG imports, GCC grid connections, and solar developments exceeding 2 GW.

Meanwhile, the KRG signed energy deals worth a total of $110 billion with two U.S. firms, HKN Energy and Western Zagros, during Prime Minister Masrour Barzani’s May 19, 2025, visit to Washington. These agreements target development of the Miran Gas Field in Sulaymaniyah and oil and gas facilities in the Tophane-Kurdamir blocks, which hold an estimated 5 trillion standard cubic feet of gas and 900 million barrels of oil. All gas from these fields will be used for power generation.

The KRG’s Ministry of Natural Resources stated that these were not new agreements, having long been in force and recognized by Iraqi courts. Baghdad, however, declared the deals illegal without federal approval. The U.S. State Department reaffirmed its support for the KRG under the agreement. While Baghdad appealed to Iraq’s Federal Supreme Court, the court upheld the agreements’ legality and dismissed the objections.

KRG and Company Demands

The KRG continues to seek energy independence from Baghdad. However, the biggest hurdle has been the demands from APIKUR member companies regarding the resumption of exports. These companies want firm guarantees on payments, the settlement of approximately $1 billion in outstanding dues, and reimbursement for production and logistics costs estimated at $16 per barrel.

The KRG, in return, demands the delivery of 115,000 barrels per day for domestic use, cost coverage for this production by Baghdad, and transportation of oil to Türkiye via the “KRG pipeline.”

However, transport through this pipeline is more expensive than the Kirkuk-Ceyhan route. Rosneft owns 60% of the KRG pipeline, while the remaining 40% is held by KAR Group, known for its close ties to the Kurdistan Democratic Party (KDP).

Recent Iraqi media reports suggest that Türkiye is seeking to raise the transit fee to $2.5 per barrel under a new export agreement with Iraq via the Ceyhan port.

Baghdad’s Heavy-Handed Moves

After the 12-day conflict between Israel and Iran, Iranian-made Shahed kamikaze drones began targeting airports and military facilities in the KRG. Shortly afterward, oil facilities were attacked as well.

Four facilities were hit in total:

- Khurmala Oil Facility (35.977506, 43.768358), owned by KAR Group near Erbil

- Sarsang Oil Field (36.906658, 43.388694), operated by U.S.-based HKN Energy in Duhok

- Semalka Oil Facility (37.079448, 42.559192) and Tawke Refinery (37.135262, 42.793964), owned by Norwegian company DNO in Zakho

(Refineries belonging to U.S.-based HKN Energy that were struck in the Duhok region – 36.893333, 43.433994)

Production at another facility operated by DNO in the Zakho region was also suspended as a precaution against potential attacks.

As a result of the attacks, the KRG’s oil production fell from 280,000 barrels per day to 150,000.

Meanwhile, Baghdad halted salary payments to public employees in the KRG since May. The combination of unpaid salaries and halved production has placed severe financial pressure on the Erbil administration.

Iran-Israel 12 Day War

During the 12-day conflict between Iran and Israel, Iraq’s airspace remained closed, severely disrupting logistics, particularly in the oil sector. But Iraq’s greater concern was not its airspace—it was the risk of Iran shutting down the Strait of Hormuz.

With exports via Türkiye and Syria suspended and only limited smuggling through Iran possible, the Strait of Hormuz remained Iraq’s only viable route. This crisis highlighted the urgent need for Iraq to develop alternative export corridors.

Türkiye’s Aim for a Larger Role

Türkiye has decided to terminate the 1973 agreement governing the operation of the Kirkuk-Ceyhan pipeline. A new draft agreement has been shared with Iraqi authorities.

In recent years, Türkiye has implemented numerous domestic and international energy projects, positioning itself as a hub for both production and distribution. Agreements with Libya, Azerbaijan, and Somalia have been signed, and Türkiye now operates the world’s fourth-largest offshore energy fleet.

(Türkiye’s energy fleet includes 2 seismic survey ships, 6 drilling vessels, and 1 natural gas production ship.)

In line with this vision, Türkiye seeks to play a more active role in Iraq’s energy landscape.

Speaking to S&P Global, Energy Minister Alparslan Bayraktar revealed that the Development Road Project may include a new energy corridor to transport both oil and gas.

(Estimated route of the Development Road Project and potential energy corridor)

Minister Bayraktar also noted that the Kirkuk-Ceyhan pipeline system—technically capable of transporting 1.5 million barrels per day—aims to reach 1 million barrels per day.

Toward Resolution

These political and economic pressures have accelerated talks between Baghdad and Erbil in recent months. After a prolonged stalemate, the two sides have reached consensus on key issues. Baghdad agreed to cover the $16-per-barrel production and logistics cost demanded by APIKUR companies. It also consented to settle approximately $1 billion in outstanding payments from future oil revenues.

In return, the KRG transferred 50% of its non-oil revenues for May (120 billion Iraqi dinars) to Baghdad. Consequently, Baghdad resumed salary payments to KRG civil servants.

The sides also agreed on a new roadmap for production and exports. The KRG began delivering 80,000 barrels per day to SOMO. Of the daily output, 50,000 barrels will be used for domestic consumption in the KRG (with costs covered by Baghdad), and 230,000 barrels are to be transferred to SOMO. Should daily production exceed 280,000 barrels (which sometimes reaches 310,000), the surplus will remain with the KRG.

SOMO stated that more barrels of oil are expected from the KRG for exports to resume. The KRG, however, says production has declined following the recent attacks. Although kamikaze UAV strikes on KRG areas continue, attacks on oil facilities have ceased since the Baghdad-Erbil agreement began nearing finalization, but the threat still persists.

However, it remains unclear which pipeline will be used for exports to Türkiye. Discussions continue on Türkiye’s proposed new energy corridor as part of the Development Road Project and its offer of a new energy agreement with Iraq.

In the coming weeks, full-scale exports are expected to resume, formalizing the agreement between Baghdad and Erbil and providing partial resolution to the long-standing energy dispute.